It is no longer fashionable to keep money in suitcases, hiding them in the storage rooms of railway stations. It will soon be technically impossible. Moreover, the money itself is already losing its significance compared to the “new oil” – information. Few companies now continue to fill out documents manually. Any forms are created using computer programs. For the transfer to government agencies or counterparties, documents are printed out, signed by an authorized person, and sealed with the seal of the organization. However, you can do without it if the data in electronic form is signed with a digital signature and transferred to the addressee using an electronic document management system. Let’s find out how to store financial data!

You Should Understand This Concept

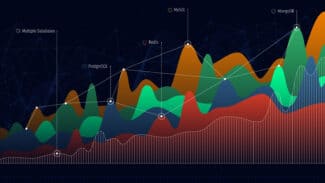

Financial data has a subject content that is aimed at analyzing and resolving financial conflict situations. They are characterized by such criteria as reliability, materiality, stability, accuracy, and relevance. In modern economic turnover, it’s part of the financial analytics market, as it is part of the operations of a purchase and sale transaction. The financial information market began to take shape as the first news agencies appeared, broadcasting information about important financial, economic, political, and other socially significant events. The first exchange dissemination systems appeared. With the advent of Internet trading and the growth in the number of investors, the number of consumers of information about the currency and securities markets, issuers, etc. has increased.

The Deciding Factor Here Is Rather the Number of Users Who Use the Same Storage Model

Electronic financial data perform the same functions as their paper counterparts while being suitable for processing by various systems. Through this, reports are transmitted to the controlling state bodies, documents are exchanged between customers and suppliers. The financial indicators of the enterprise also include such general economic indicators as a reduction in the cost of production and construction and installation works, a reduction in distribution costs in supply and trade.

By tracking important economic and marketing metrics, you can plan. Look at the tablet in Excel or the report of the analytics system, and it will immediately become clear whether the company can afford another employee, whether there will be a cash gap in six months, whether it is profitable to take a loan, or in the current situation it will simply ruin the business. Changing the accepted content and form of the financial balance sheet, income statement, and explanations to them are allowed in exceptional cases, for example, when changing the type of activity. The organization shall justify each such change. A material change must be disclosed in the notes to the balance sheet and income statement, together with an indication of the reasons for the change.

More Tips

Indicators of individual assets, liabilities, income, expenses, and business transactions should be presented separately in the financial statements if they are material and if, without knowledge of them by interested users, it is impossible to assess the financial position of the organization or the financial results of its activities. Indicators of certain types of assets, liabilities, and business transactions may be presented in the financial balance sheet or income statement as a total amount with disclosure in the notes to the balance sheet and income statement. If each of these indicators individually is not material, especially to assess the financial position of the organization or the financial results of its activities by interested users.

How to Store Financial Data?

This aspect consists of the principles of content, archiving, and preservation of the necessary information. Financial data is first transferred to the personal archive of the enterprise through the information and telecommunication network responsible for archival data storage. Data can be stored in multiple copies, most commonly, companies use a master and working copy. The master copy is the final version of financial data reporting, which should not contain errors. The working version is often subject to changes, additions, or innovations. After transferring data to the archive, you should decide on the type of storage. In modern companies, such types of storage as paper media or computer files are preferred. Preferred options for computer files are Word, Excel, PDF, or archived documents.

Components of Financial Data

Each financial data must contain the following items: the name of the constituent part; an indication of the reporting date or reporting period for which the financial statements were prepared, the name of the organization, indicating its organizational and legal form, and the format for presenting numerical indicators of the financial statements. If the data has been damaged, then it must be restored with the authenticity of the original. The method of data storage excludes the illegal distribution, destruction, and distortion of information. For each financial data or reporting, the company appoints a responsible person, but if there is no such person, then the director of the company is responsible for the safety of financial data.

Considering the types of data, one can single out such a classification of financial data storage – local and cloud. Local storage is a directory of files collected in one area. If an employee needs a file, then he must first review all classifications and then find the desired section with data. The disadvantage of this type of storage is public availability, since the data of the paper version is difficult to encrypt, so everyone can have access to information. The opposite of the local type is cloud storage, which is based on a technology approach. Each financial data is stored in remote access of a limited type. The advantages of local storage are obvious – only the administrator grants access to the server, but the user can only view the file. To edit a file with financial data, an employee must request permission from the administrator to download the file. Often the document itself has an encryption system, the password to which only the creator of the reporting knows. Recently, such a type of financial analytics storage as an electronic document management system is gaining popularity.

That’s It!

Now we hope you liked this article and figured out the best ways to store financial data! Leave your comments and share your experience with us!