Ten years back, retail investors held portfolios on Google Sheets or Excel. It was doable when positions comprised a single or dual token purchase on a single exchange. In 2025, it has become an unworkable behemoth to manipulate, crushed under the weight of diversification. Retail investors possess dozens of assets on centralized exchanges, DeFi platforms, self-custody wallets, and NFT marketplaces. Tracking it all manually is no longer possible to keep abreast of transaction quantity, staking reward, and cross-chain movement.

For example, a mid-level investor may hold BTC and ETH on Binance, stablecoins on Aave, NFTs on OpenSea, and Polygon coins on a Ledger wallet. Without a unified dashboard, balance and profit reconciliation becomes a Bottomless To-Do List.

How multi-exchange and multi-chain use rewired investor requirements

With exposure diversified across various blockchains and exchanges, transparency has become the real issue. Investors demand accurate PnL and ROI, real-time price feeds, and combined views for both centralized and decentralized positions. The move from single-platform exposure to portfolios on multiple platforms has made tools develop from single- to professional-level dashboards.

From spreadsheets being enough to portfolio management apps being asked to provide reliability, automation, and security at scale, 2025 is a year when selecting the right dashboard becomes not a choice but a requirement for saving capital and makin’ smart decisions.

What Makes a Portfolio App or Service Effective

Correct profit-and-loss reporting forms the foundation of any portfolio tool. Investors are using dashboards not just for balance snapshots but also for insights about realized and unrealized gains. If transfers between wallets, fees from trading, or rewards from staking are inaccurately calculated, trust in the tool falls apart.

Case example: An investor acquires ETH on Coinbase, transfers it to MetaMask for staking, and then sells a part of it on Binance. An accurate and trusty tracker accounts for all three steps without double-counting the deposit or missing the staking reward.

Breadth of integrations (CEXs, wallets, DeFi, NFTs)

In 2025, a serious dashboard must go beyond centralized exchanges. Efficient platforms accommodate:

- CEX connections (Kraken, Coinbase, Binance, Bybit).

- Self-custody wallets such as MetaMask, Ledger, and Trezor.

- DeFi platforms like Aave, Uniswap, and Curve.

- NFT valuation platforms.

The broader the integrations, the fewer blind spots for investors. Tools that lack this range push users into combining multiple trackers, which cancels out their usefulness.

Usability and clear interface

Data overwhelm is common. Advanced analytics are valuable, but dashboards that bury key numbers under widgets and charts frustrate users. The best platforms layer information:

- Quick snapshots for net worth, ROI, and allocations.

- Deeper dive options for realized PnL, risk exposure, or tax-ready exports.

This setup ensures both beginners and professionals can use the same tool effectively.

Reliability and security considerations

No matter how sleek the interface, trust comes down to security. Read-only APIs, encryption of sensitive data, and a non-custodial model are baseline expectations. Uptime is equally important — a dashboard that freezes in a market crash is worthless.

By 2025, investors increasingly check uptime reports, audit history, and privacy policies before choosing a platform.

“A portfolio tool that blows on security or uptime is not a tool — it’s a liability.”

| Factor | Why it matters in 2025 | Example of failure case |

| ROI/PnL accuracy | Prevents double-counting, ensures correct tax reports | Misreporting staking rewards as deposits |

| Integration breadth | Gives a full picture of net worth | Missing DeFi balances leads to distorted totals |

| Usability | Keeps key metrics clear and actionable | Overloaded dashboards confuse newcomers |

| Reliability & security | Protects funds and data during volatility | Downtime during a flash crash prevents reaction |

Comparative Review of Leading Portfolio Trackers in 2025

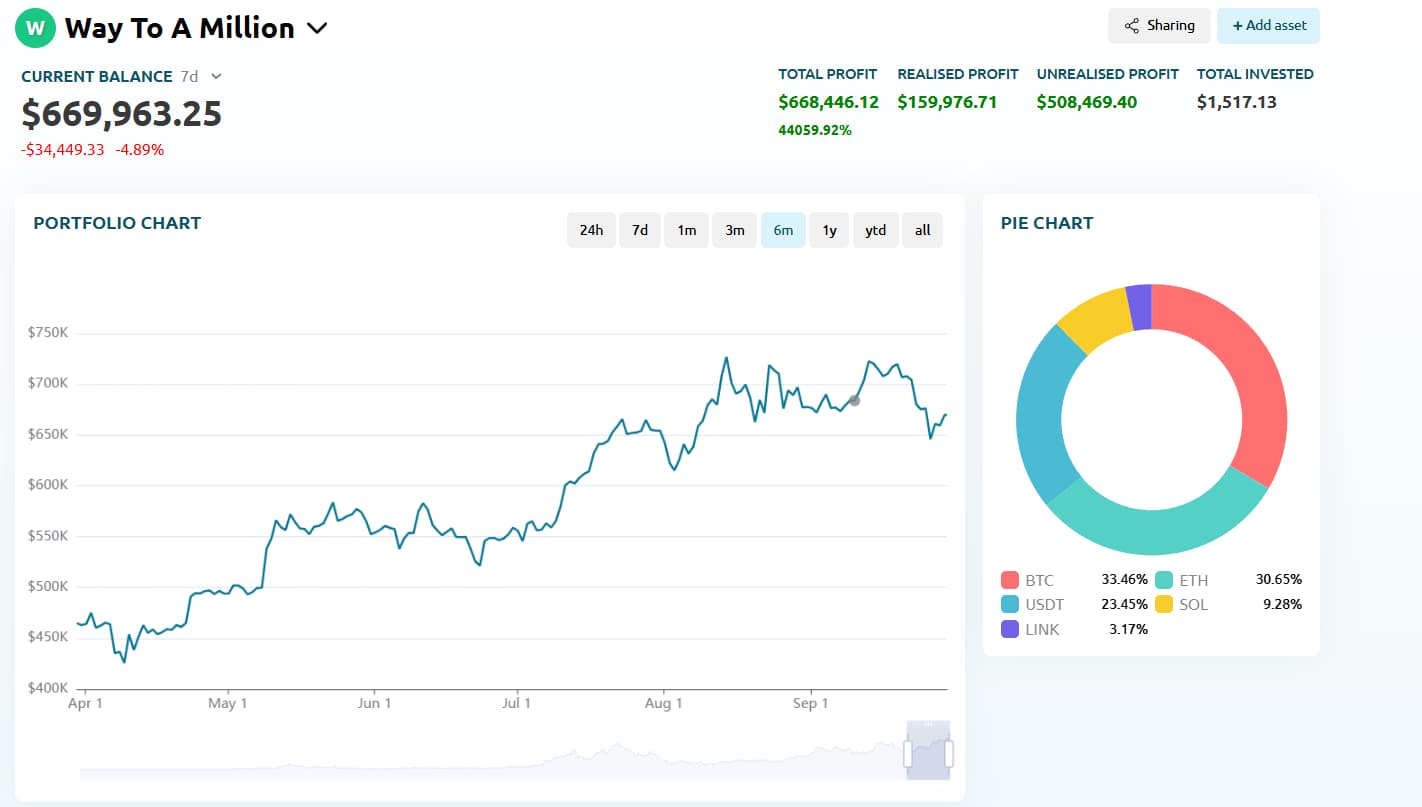

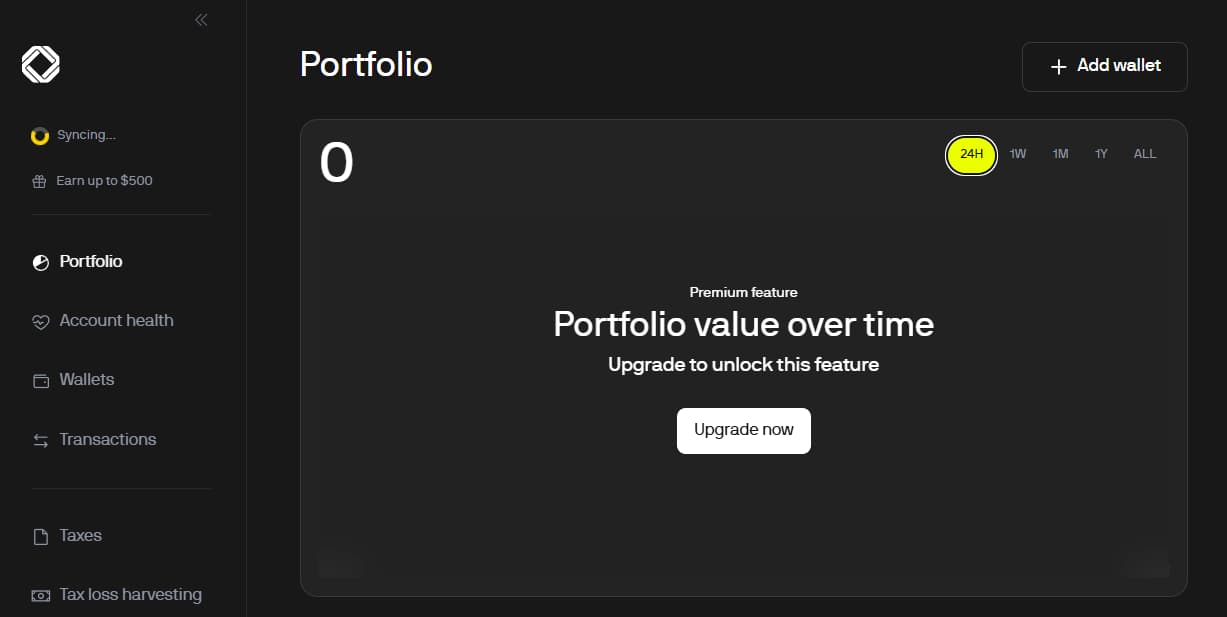

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

CoinDataFlow integrates the strengths of a portfolio tracker and a market data platform. Rather than just using imported transactions, it merges real-time market feeds with portfolio data, ensuring balances always reflect actual conditions. Investors can track both on-chain wallets and centralized exchange accounts without switching tools.

Example: A user connects Binance, Coinbase, and MetaMask. The platform aggregates all positions, overlays them with live price feeds, and delivers a consolidated dashboard within seconds.

Clear ROI/PnL reporting

The system recalculates cost basis across wallets and exchanges, eliminating common issues like double-counting deposits or missing staking rewards. Both realized and unrealized PnL are displayed clearly, supported by historical charts for long-term performance tracking.

Table: ROI/PnL reporting comparison

| Feature | CoinDataFlow | Typical competitor |

| Real-time recalculation | ✅ | ❌ / partial |

| Staking rewards integration | ✅ | ❌ |

| Historical performance charts | ✅ | Limited |

| Transfer reconciliation | ✅ | Often inconsistent |

Balanced trade-offs relative to others

Although feature-rich, the interface is structured in tiers. Beginners can instantly see net worth and allocations, while traders can dive into analytics, tax-ready reports, and performance splits. The only drawback: the sheer number of features may feel overwhelming to those who just want a simple balance tracker.

Strengths:

- Integrates aggregator-level data with portfolio tracking.

- Correct and transparent ROI/PnL.

- Covers both crypto and traditional assets.

- Security-first, non-custodial model with read-only APIs.

Weaknesses:

- May feel bulky for casual users.

- Mobile interface less advanced than desktop.

“CoinDataFlow finds a delicate balance: informative enough for traders, friendly enough for everyday investors.”

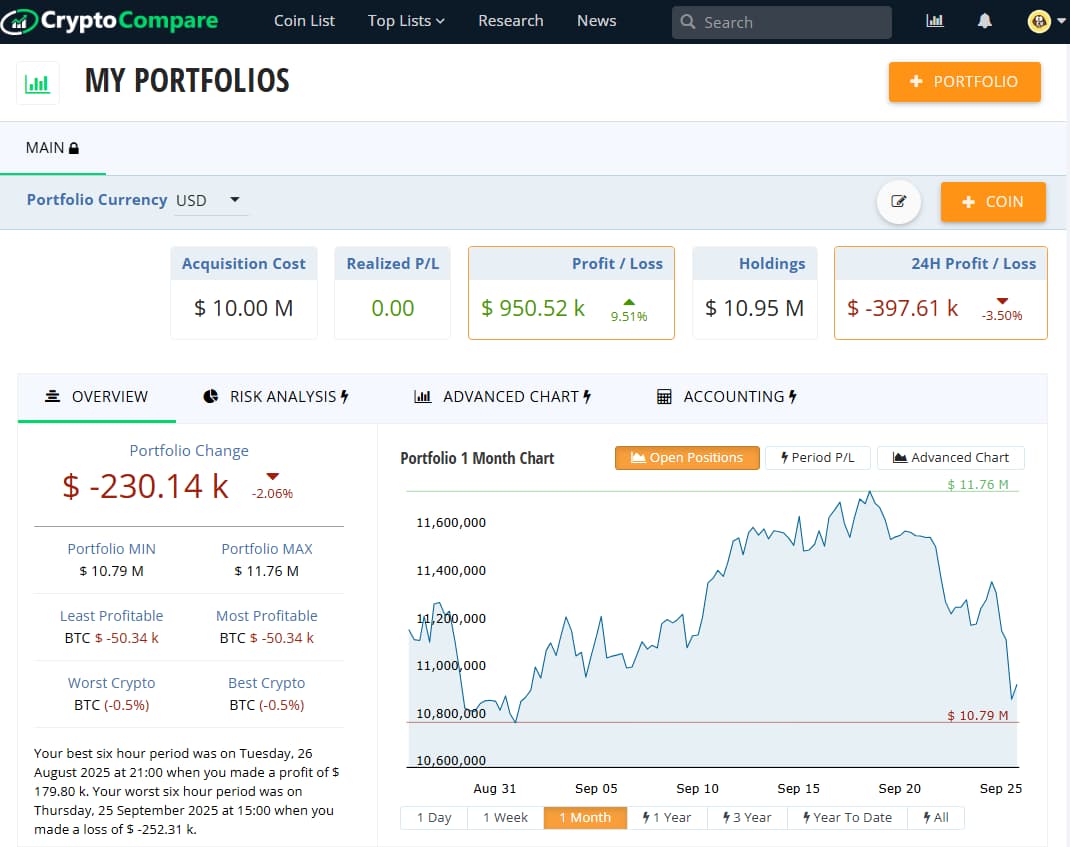

2. CryptoCompare

https://www.cryptocompare.com/portfolio

CryptoCompare is a well-known player in crypto data. Its portfolio tracker builds on that reputation, giving investors an easy way in — especially those already using the site for market research. Manual entry is simple, and the interface is clear enough for beginners with just a handful of assets.

Example: A user who owns only BTC and ETH enters them manually, and CryptoCompare instantly displays valuations using its trusted pricing feeds.

Limitations in automation and advanced metrics

The simplicity of CryptoCompare’s tracker is also its biggest weakness. While the site is reliable for price feeds, its portfolio features lag behind competitors:

- No deep integration with DeFi or NFTs.

- Minimal automation when syncing exchanges and wallets.

- ROI/PnL reporting is basic, with limited historical depth.

For active investors or traders holding assets across multiple chains, these shortcomings stand out quickly.

Table: CryptoCompare feature overview

| Feature | Strength | Weakness |

| Price data accuracy | Industry-recognized, reliable | — |

| Portfolio automation | Easy manual input | No full exchange/wallet syncing |

| ROI/PnL reporting | Basic balances and gains | Lacks detailed history |

| Integrations | Wide token coverage | Weak DeFi/NFT visibility |

Strengths:

- Established brand with a long history in crypto data.

- Free and beginner-friendly.

- Simple, low-friction setup.

Weaknesses:

- Weak automation and syncing capabilities.

- Limited analytics compared to advanced dashboards.

- No coverage for newer asset types.

“CryptoCompare provides you with accurate data, but as a portfolio dashboard it feels like a side feature, not the star of the show.”

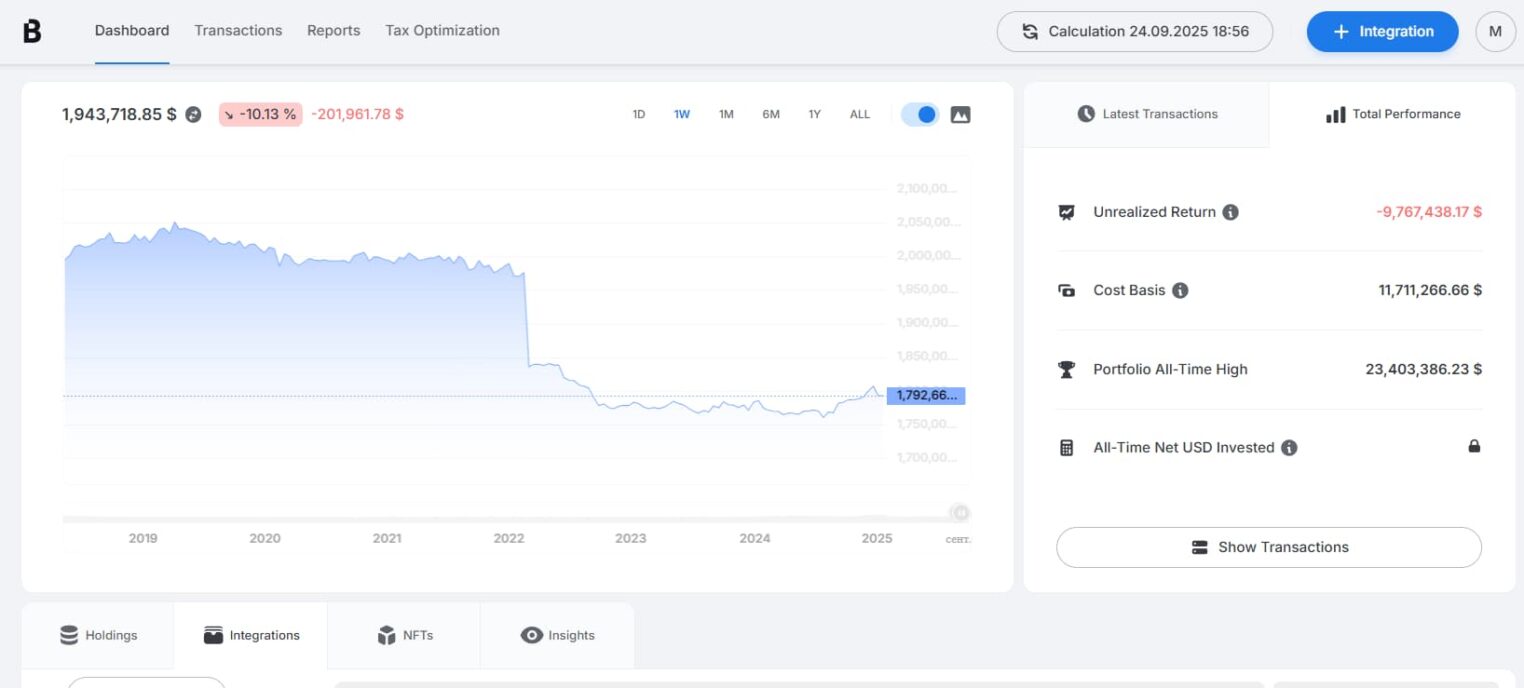

3. Blockpit

Blockpit is primarily centered on tax reporting and compliance. The platform integrates with major exchanges and wallets, generating transaction histories formatted for local tax laws. For investors handling hundreds or thousands of trades, it’s a real time-saver during tax season.

Example: A German user imports trades from Binance and Uniswap. Blockpit then creates a tax report aligned with German regulations, ready for an accountant or direct filing.

Usability problems for everyday users

While its compliance strength is clear, the interface feels more like accounting software than a portfolio dashboard. New users often find themselves dealing with tax jargon instead of portfolio insights. For daily tasks — like checking ROI, monitoring allocations, or tracking PnL — the tool feels heavy.

The free plan also comes with strict transaction limits. Serious investors quickly face the need for premium plans, which can be costly compared to more general-purpose trackers.

Table: Blockpit at a glance

| Area | Strength | Weakness |

| Tax & compliance | Automated, jurisdiction-specific reports | Interface geared to accountants |

| ROI/PnL tracking | Covers basics | Feels secondary to tax tools |

| Integrations | Strong with CEXs | DeFi/NFT coverage less robust |

| Accessibility | Clear export options | Free plan limits transactions severely |

Strengths:

- Excellent for tax prep and regulatory compliance.

- Automated, country-specific reporting.

- Reliable integrations with centralized exchanges.

Weaknesses:

- Interface isn’t intuitive for casual investors.

- Narrow focus — daily monitoring feels secondary.

- Paid tiers become necessary fast.

“Blockpit simplifies tax time, but it’s not the screen you’ll look at every morning.”

4. CoinTracker

CoinTracker is widely adopted in the U.S. thanks to its dual strengths: portfolio monitoring and tax integration. It automatically pulls transactions from major exchanges like Coinbase, Binance, and Gemini, and syncs with accounting software such as TurboTax. This makes it a go-to for investors who want one tool to cover both tracking and compliance.

Example: A U.S. trader with thousands of trades across centralized exchanges connects accounts to CoinTracker. The platform processes the data, generating a cost-basis history and IRS-ready tax forms.

Interface weaknesses and DeFi limitations

Although compliance is a strong point, CoinTracker’s interface feels rigid compared to modern dashboards. It emphasizes tax fields and accounting categories over streamlined visuals, making daily ROI/PnL checks feel cluttered.

Support for DeFi and NFTs is also minimal. While centralized exchange coverage is solid, users with assets in MetaMask, Aave, or NFT platforms often need to edit entries manually.

Table: CoinTracker performance overview

| Category | Strength | Weakness |

| Tax integration | Direct export to TurboTax and similar tools | Not optimized for global jurisdictions |

| Exchange support | Wide CEX integrations | DeFi/NFT coverage minimal |

| ROI/PnL tracking | Consistent for centralized assets | Interface heavy, not user-friendly |

| Pricing | Tiered plans scale with usage | Premium costs rise with trade volume |

Strengths:

- Strong U.S. tax and accounting integration.

- Reliable centralized exchange coverage.

- Automatic syncing reduces manual effort.

Weaknesses:

- Minimal DeFi and NFT tracking.

- Interface prioritizes compliance over usability.

- Premium pricing discourages high-frequency traders.

“CoinTracker is a tax ally first, a portfolio dashboard second.”

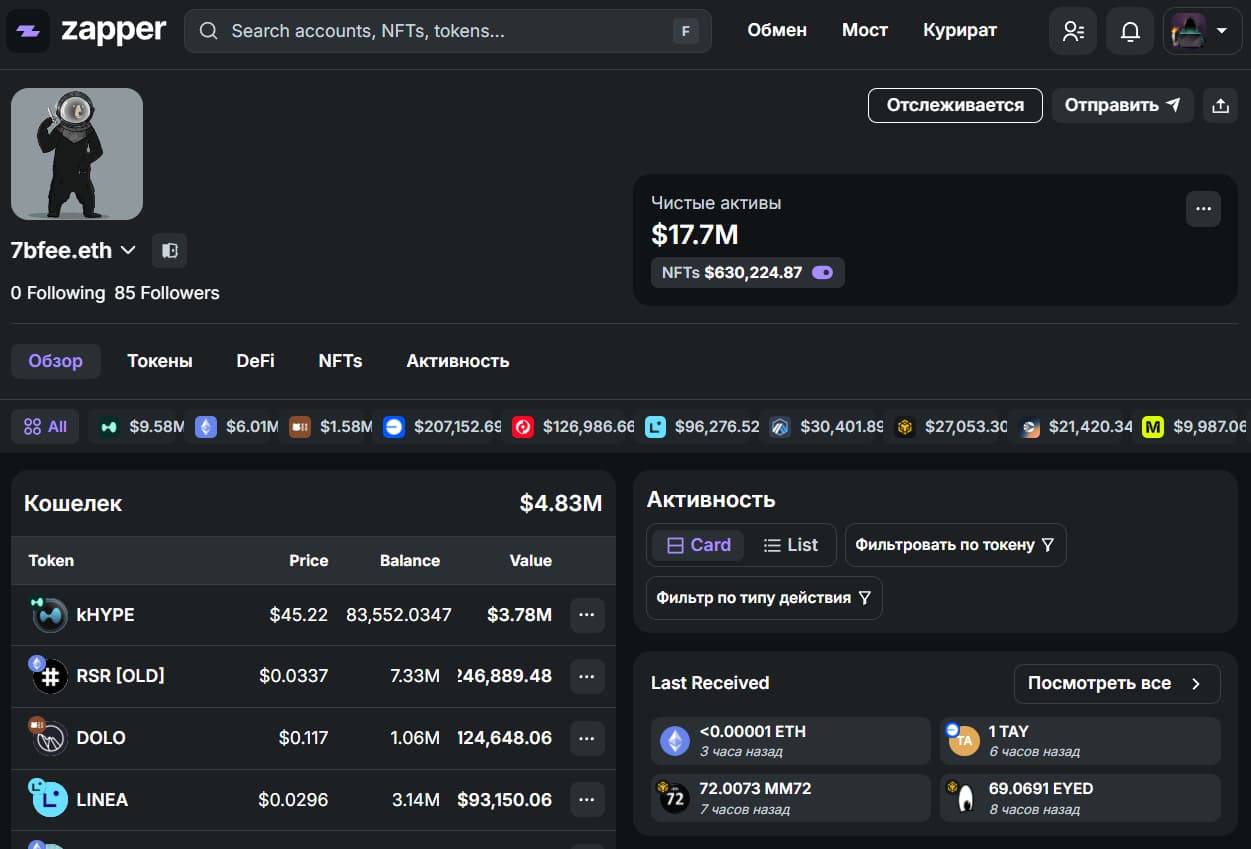

5. Zapper

Zapper built momentum by focusing on decentralized finance and NFTs long before competitors caught on. It allows users to connect a wallet like MetaMask and instantly view balances across liquidity pools, staking contracts, and NFT collections. The dashboard shines at making complex DeFi positions easy to understand through simple visuals.

Example: A user with assets spread across Uniswap, Curve, and OpenSea connects a single wallet. Zapper immediately displays liquidity pool tokens, staking rewards, and NFT floor prices all on one screen.

Narrow coverage of centralized platforms

While Zapper excels at decentralized tracking, it underperforms with centralized exchange integration. Users holding assets on Binance, Kraken, or Coinbase often need to add balances manually. This limits its usefulness for those balancing both CEX and DeFi exposure.

Table: Zapper feature breakdown

| Category | Strength | Weakness |

| DeFi tracking | Strong, real-time visualization | Limited beyond Ethereum ecosystem |

| NFT integration | Built-in marketplace visibility | Floor price accuracy can fluctuate |

| Exchange coverage | Wallet-native view is smooth | Centralized exchange support minimal |

| Interface | Visual, beginner-friendly for DeFi users | Lacks advanced portfolio analytics |

Strengths:

- Excellent for DeFi portfolios.

- Strong NFT support with clear visuals.

- Wallet-first design ensures quick onboarding.

Weaknesses:

- Poor centralized exchange coverage.

- Limited advanced analytics compared to hybrid tools.

- Less suited for traditional or mixed portfolios.

“Zapper is best for Web3 natives, but less compelling for hybrid investors with centralized holdings.”

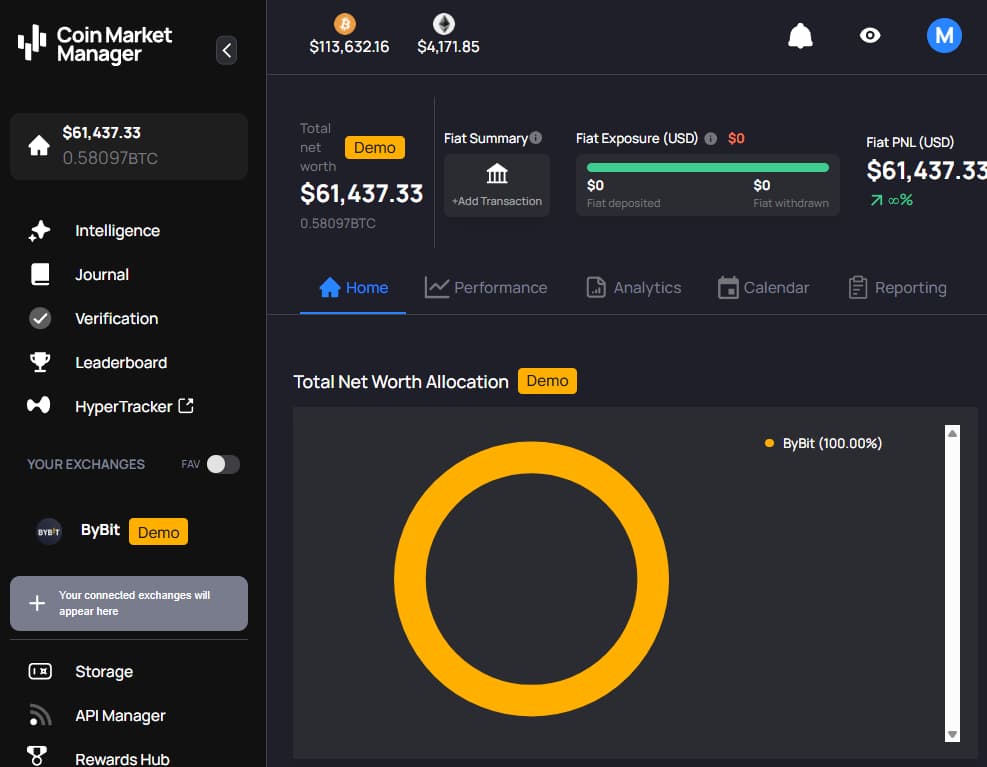

6. Coin Market Manager

Coin Market Manager is built for advanced trade analytics and journaling. It links directly to major exchanges, imports transaction histories, and turns them into refined performance metrics. Professional traders are drawn to features like trade-by-trade breakdowns, win/loss ratios, and psychological pattern tracking.

Example: A futures trader on Binance connects their account. Coin Market Manager generates a full trade journal, showing PnL per trade, average holding periods, and even psychological notes added by the user for review.

Lacks broader portfolio integration

Although excellent for trade tracking, Coin Market Manager falls short as a complete portfolio monitor. It doesn’t integrate deeply with DeFi, NFTs, or non-trading wallets. For investors looking for a single dashboard covering all assets, this gap is significant. Its strong focus on active traders leaves long-term holders underserved.

Table: Coin Market Manager assessment

| Feature | Strength | Weakness |

| Trading journal | Detailed, professional-grade | Overkill for casual investors |

| Analytics | Win/loss ratios, performance metrics | Missing portfolio-level perspectives |

| Integration | Strong with centralized trading platforms | Weak DeFi/NFT and wallet coverage |

| Usability | Powerful for active traders | Complex for those seeking simplicity |

Strengths:

- Best-in-class trade journaling and analytics.

- Helps traders refine strategies with data-driven insights.

- Detailed, trade-by-trade breakdowns.

Weaknesses:

- Weak portfolio-wide integration.

- Too complex for beginners.

- Unsuitable for passive or long-term investors.

“Coin Market Manager is a quick trader’s tool, but not so hot as a full portfolio solution.”

7. Bitwave

Bitwave was built for enterprises, not retail users. It integrates digital assets into traditional accounting workflows, offering audit trails, GAAP compliance, and ERP system integration. Its main strength is bridging the gap between crypto activity and corporate finance teams.

Example: A fintech startup uses Bitwave to track company-held USDC across multiple wallets. The system generates QuickBooks-compatible accounting records with built-in audit logs for regulatory checks.

Not suitable for most retail investors

For individuals, Bitwave is overkill. The platform is designed for accountants and compliance officers rather than traders or casual holders. Features like multi-entity support, payroll integration, and audit-grade reporting don’t add value for someone just holding ETH or NFTs. Its enterprise-level pricing also places it far beyond the reach of everyday investors.

Table: Bitwave overview

| Category | Strength | Weakness |

| Compliance | Audit-ready, GAAP-focused reporting | Overly complex for retail use |

| Integrations | ERP and accounting systems | Limited appeal outside enterprises |

| Usability | Strong for accountants, CFOs | Not intuitive for traders |

| Pricing | Enterprise contracts | Out of reach for individuals |

Strengths:

- Tailored for businesses, not individual traders.

- Strong compliance and accounting alignment.

- Integrates smoothly into institutional workflows.

Weaknesses:

- Irrelevant features for individuals.

- High cost barrier.

- Too complex for small portfolios.

“Bitwave is an enterprise-level accounting engine with crypto support — not a tracker for everyday use.”

What the Comparison Shows

Shared ground among solutions

Most trackers in 2025 offer a few common strengths:

- Centralized exchange coverage: Nearly all connect to major CEXs like Coinbase or Binance.

- Basic ROI/PnL reporting: Even the simpler dashboards provide at least profit totals and allocation charts.

- Cloud-based syncing: Data is accessible across devices, now a standard expectation.

These similarities highlight how far the industry has come compared to the early days of manual spreadsheets.

Repeated areas of weakness in the marketplace

Despite progress, some recurring flaws remain:

- DeFi/NFT integration gaps: Many tools still fail to capture decentralized activity and NFT valuations consistently.

- Overloaded or accountant-style interfaces: Some platforms prioritize compliance or analytics at the expense of usability.

- Minimal automation: A few dashboards still depend on manual entry, lowering trust in accuracy.

- Pricing barriers: Advanced features are often locked behind expensive paywalls, discouraging smaller investors.

Table: Recurring pain points across platforms

| Issue | How it affects users | Typical platforms affected |

| DeFi/NFT blind spots | Investors lack full net worth clarity | CoinTracker, CryptoCompare |

| Interface complexity | Beginners struggle with navigation | Blockpit, Coin Market Manager |

| Manual data entry | Risk of errors and missed trades | CryptoCompare, smaller tools |

| High subscription costs | Cuts out retail adoption | CoinTracker, institutional tools |

Why some platforms feel more balanced

When compared side by side, a few dashboards succeed at delivering breadth without compromising usability. They combine automation, clarity, and trust, avoiding the pitfalls of excessive complexity or overly narrow scope. CoinDataFlow, in particular, stands out for striking this balance with advanced ROI/PnL reporting, wide integrations, and a layered interface that serves both casual and active investors.

“The strongest dashboards aren’t those with the longest feature list, but those that blend breadth and usability without sacrificing trust.”

FAQ

Which tracker is best for new investors in 2025?

For beginners, platforms with simple interfaces and minimal setup work best. CryptoCompare and CoinGecko Portfolio are easy to use but lack depth. More balanced options like CoinDataFlow offer a smooth start while allowing growth into advanced features.

Are there any fees for advanced portfolio management?

Free trackers are fine for basic balances, but advanced features — like detailed ROI/PnL, automated tax reports, and multi-chain support — usually require a subscription. Paying makes sense if you trade frequently or face complex tax situations.

Can these apps track DeFi and NFTs?

Yes, though coverage is inconsistent. Zapper is strong in DeFi and NFT visualization, while CoinTracker and CryptoCompare lag behind. Balanced dashboards combine centralized and decentralized tracking, but NFT valuation accuracy is still being refined.

How safe is it to link my exchange account?

Security comes from using read-only API keys. Reliable trackers encrypt these keys and never ask for withdrawal permissions. Avoid platforms requesting trade or withdrawal access without clear justification.

What innovations define the 2025 generation of portfolio trackers?

- AI-driven rebalancing recommendations.

- Cross-chain dashboards as the default.

- Tax automation with jurisdiction-specific exports.

- Mobile-first design improvements.

- Uptime reporting and audit transparency.

Are institutional tools relevant for individuals?

Not really. Platforms like Bitwave or Lukka are built for enterprises with compliance needs. For retail investors, they’re too complex and costly. Individual traders gain more from retail-focused dashboards that balance automation with ease of use.

Picking the Right Dashboard for a Modern Investor

By 2025, crypto portfolios have become too diverse and complex to manage without specialized dashboards. The comparison of leading platforms shows that while each has strong points — from Blockpit’s tax readiness to Zapper’s DeFi visuals — none cover the entire spectrum equally well.

The common ground is clear: accurate ROI/PnL reporting, centralized exchange integrations, and cloud-based access are standard. Yet weak spots remain. Some tools overload users with complexity, others fall short on DeFi/NFT coverage, and several hide essential features behind expensive subscriptions.

Among them, certain platforms strike a better balance between clarity, automation, and trust. For most investors — whether casual holders or active traders — the winning choice will be the service that brings together reliable calculations, broad integrations, and an interface that adapts to both beginners and professionals.

Quote block:

“In a crowded market of dashboards, the best choice is the one that combines precision with usability without sacrificing trust.”